Inventory depreciation calculator

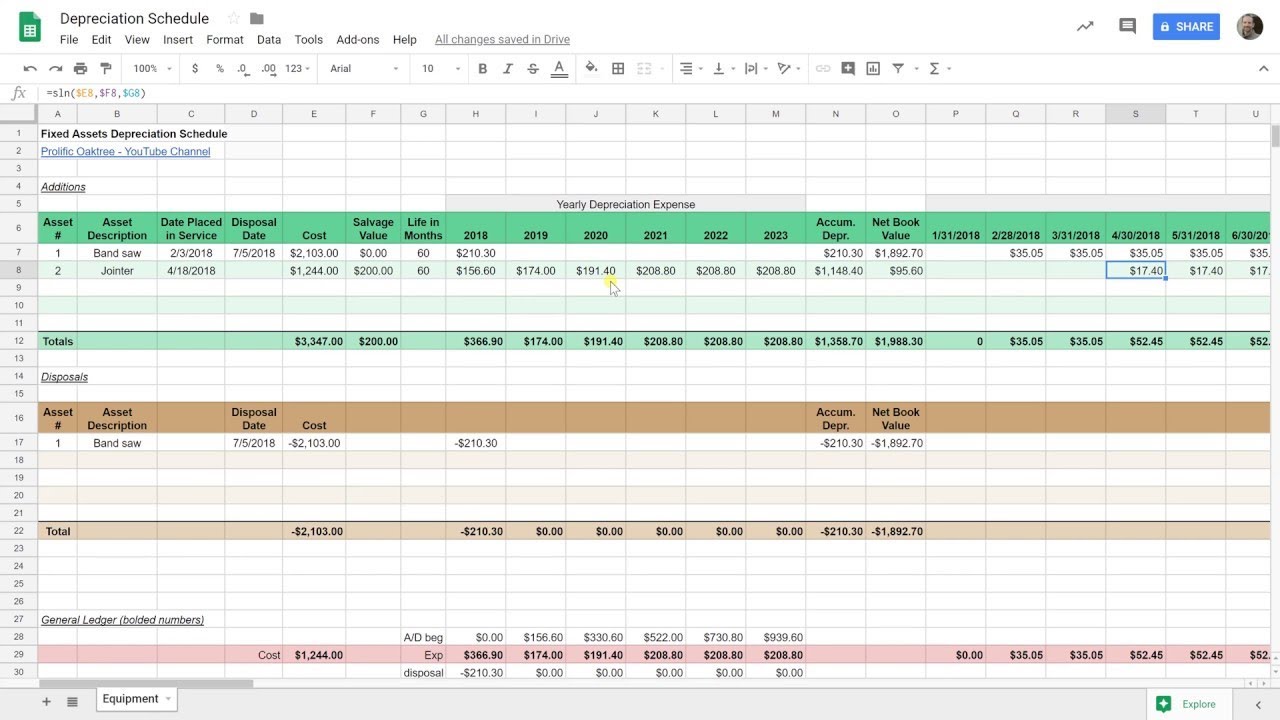

Section 179 deduction dollar limits. Annual and monthly straight-line depreciation as well as current value are automatically calculated within the Excel depreciation schedule.

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

If you have any questions about how they work or even.

. Also includes a specialized real estate property calculator. We calculate inventory turnover by dividing the value of sold goods by the average inventory. This limit is reduced by the amount by which the cost of.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Keep an inventory of your capital equipment at your business locations with this equipment inventory and depreciation schedule template. The algorithm of this inventory turnover ratio calculator applies the equations explained here while it returns the results presented in the next rows.

Useful Life in Yrs. The raw material is even appreciated for many reasons like a flood increasing the. Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

To use a double-declining credit select the declining ratio and then raise the depreciation factor to 2. The Depreciation Calculator computes the value of an item based its age and replacement value. Salvage Value of the Asset.

You can browse through general categories of items or begin with a keyword search. We calculate the average inventory by adding our starting and finishing inventories together and dividing by two. Inventories are the raw material and the raw material is not deprecated.

The formula to calculate annual depreciation through. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Select the currency from the drop-down list optional Enter the.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. Inventory depreciation calculator Jumat 09 September 2022 Edit. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

Initial cost of asset. He plans to sell the scrap at the end of its useful life of 5 years for 50. Should a company be cyclical the best way of assessing its operations is to calculate the average on a monthly or quarterly basis.

Calculate the annual depreciation Ali should book for 5 years. Percentage Declining Balance Depreciation Calculator. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Inventory turnover ratio Cost of the. All you need to do is. Depreciation for any period.

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the. After choosing the method enter the cost amount of the financial asset. It is fairly simple to use.

For example if you have an asset. For instance a widget-making machine is said to depreciate whe. The Depreciation Calculators are completely free for anyone to use and we hope that they provide the user with all of their needs.

Asset Depreciation - straight Line Method Calculator. This is an accessible depreciation schedule for equipment template. The calculator also estimates the first year and the total vehicle depreciation.

Inventories Are the Raw Material.

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Download Depreciation Calculator Excel Template Exceldatapro

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

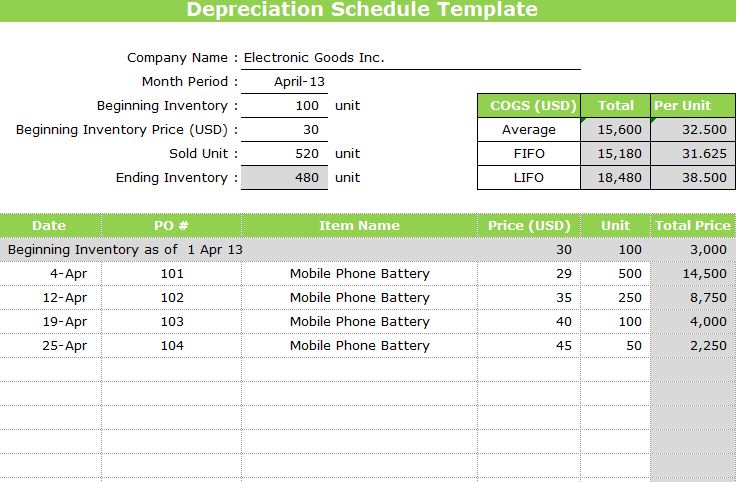

Inventory Formula Inventory Calculator Excel Template

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Depreciation Formula Examples With Excel Template

Depreciation Calculator Definition Formula

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

What Is Accumulated Depreciation How It Works And Why You Need It

Straight Line Depreciation Calculator Double Entry Bookkeeping

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator Property Car Nerd Counter

Depreciation Schedule Template Depreciation Schedule Excel

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping